Scottish Widows

Tips for Tax Year End

Pensions are a tax-efficient way to save for your future because you receive tax relief on your contributions, and your savings aren’t taxed while they’re invested in your workplace pension scheme. Please find below a useful video, fact sheet and guidelines on how to make your own one-off payment as well as other things that you can do before the tax year end.

Any additional payments into your individual pension must be submitted and paid by 28th March @ 3:30pm to be cleared in time for the end of the tax year.

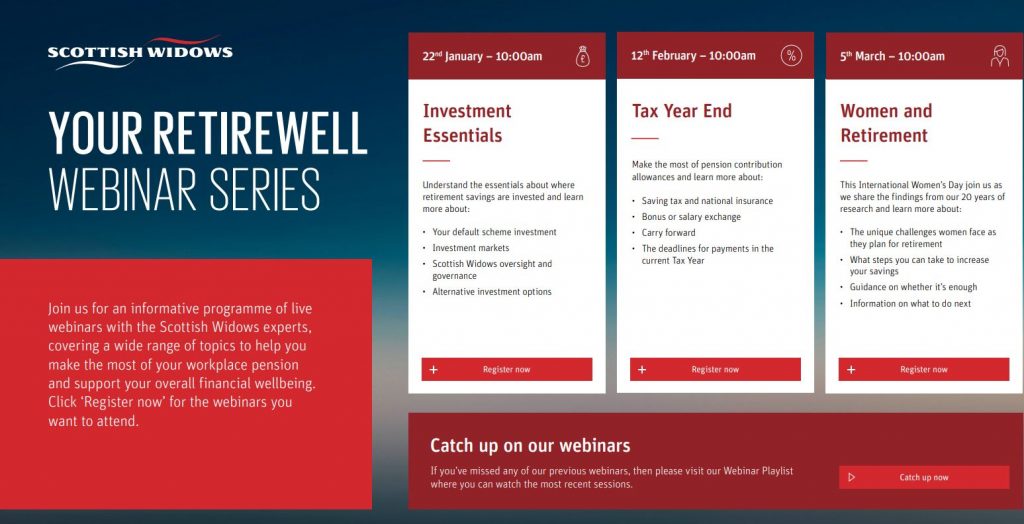

The RetireWell details at the bottom of the page will allow you to register for upcoming Scottish Widows webinars, and catch up on previous webinars.

Pensions are a long-term investment. The retirement benefits you receive from your pension plan will depend on a number of factors, including the value of your plan when you decide to take your benefits, which isn’t guaranteed and can go down as well as up. The value of your plan could fall below the amount(s) paid in. The tax treatment of your plan depends on your individual circumstances. Your circumstances and tax rules may change.

If you’re looking to make the most of your finances and reduce your tax bill for 2024/25 now is the perfect time. These top tips can help you make the most of your current allowances and tax relief, but be quick as they’ll need to be done by the 5th April 2025 or you’ll miss out…

1) USE UP YOUR FULL ISA ALLOWANCE

2) MAXIMISE YOUR TAX-FREE PERSONAL ALLOWANCE

3) PAY MORE INTO YOUR PENSION

4) MAKE USE OF THE MARRIAGE ALLOWANCE

5) GET TAX RELIEF ON GIFT AID DONATIONS

6) CHECK YOUR CHILD BENEFIT STATUS

Click here for further details on each top tip…

![Logo_PBS_(Blanc)[1] Logo_PBS_(Blanc)[1]](https://www.pbs-offshore.com/wp-content/uploads/elementor/thumbs/Logo_PBS_Blanc1-qb1ytyh1br7elvqm39d9apjqqwfw3p3w5mz7cul9s2.png)